Successfully Navigating the No Surprises Act

The No Surprises Act (NSA) is a consumer protection law designed to relieve the burden of unexpected billing and shifts the responsibility to payers and providers. While the law is clear in expectations, the path to compliance has been less certain. CMS audits are revealing incorrect QPA (qualified payment amount) calculations while providers continue to send balance bills to patients. Payers are continuously seeking a better way to comply with NSA and are looking for a solution to tackle their caseload.

At Reliant, we identify three essential strategies that can assist payers in not only preventing surprise bills for patients but also avoiding unexpected challenges in maintaining NSA compliance and avoiding additional costs.

Calculating QPAs the Right Way

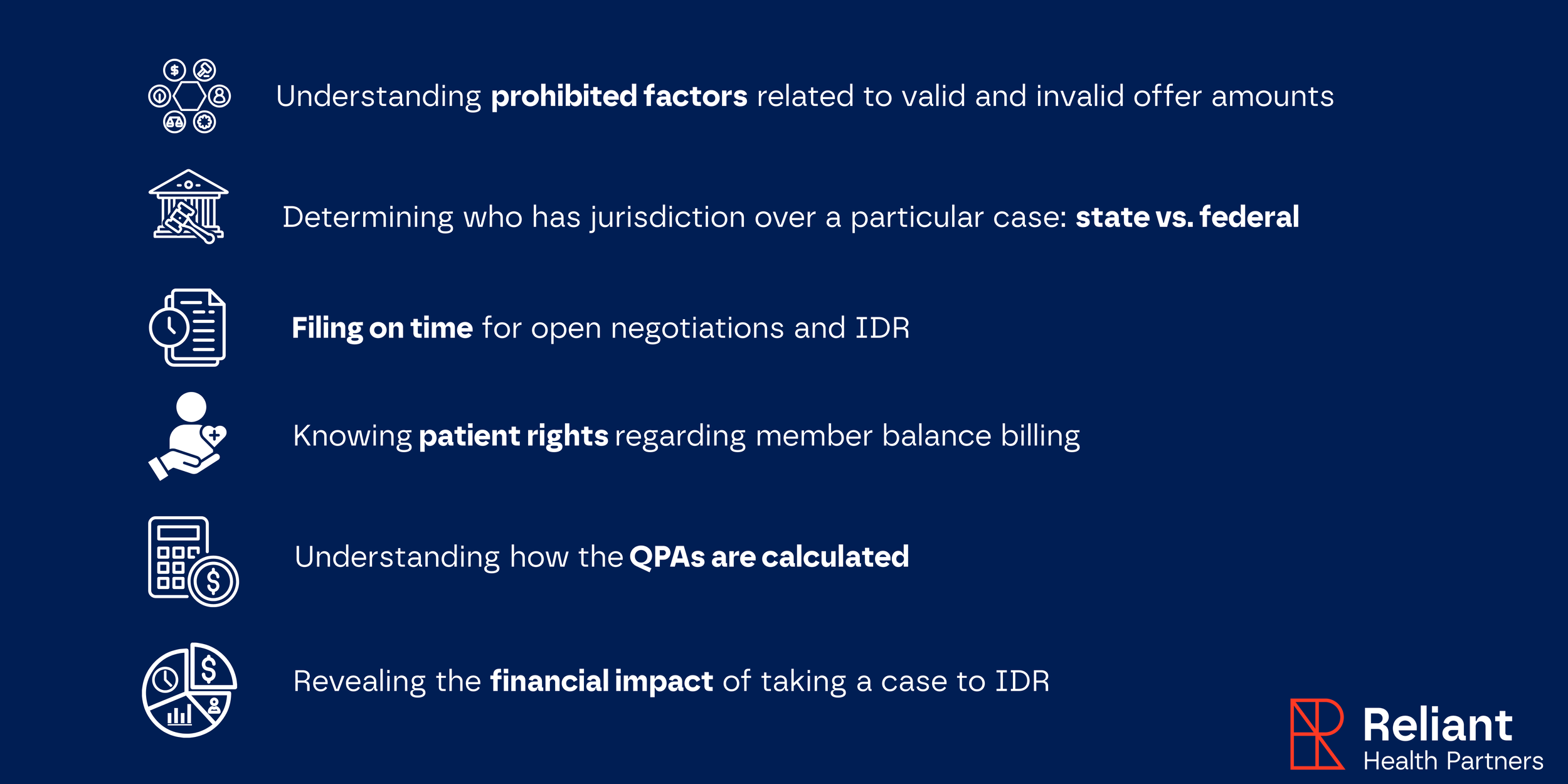

In the urgency to meet NSA requirements, many payers may not be utilizing the correct data, logic and ongoing updates to be compliant as evidenced by CMS audits. To assist payers with QPA calculations, Reliant leverages proprietary logic for adhering to complex and evolving regulatory rules. Our Automated QPA Calculator uses multiple data sources and considers every nuance of the NSA or applicable state balance billing law to precisely calculate QPAs and initial payment.

The result: payers can be confident they’re calculating QPAs that are highly defendable during CMS audits and the IDR process.

Avoiding IDRs

Frustration among payers continues to grow as more and more providers initiate the IDR process and the federal government has struggled to keep pace. To add to the frustration, 70% of cases were dismissed due to ineligibility related to timeliness, jurisdiction (state vs. federal) and batching/bundling. Lawsuits challenging how IDR is handled are creating an ever-evolving environment that requires constant monitoring and adaption to stay complaint and avoid extra costs.

There is a better strategy: staying out of IDRs in the first place. Reliant helps by educating providers around such key topics as:

Empowering Members to Manage Balance Bills

Despite its role as a consumer protection law, much of the NSA’s focus concentrates on the financial relationship between payer and provider. The challenge is ensuring the relationship works in the patient’s best interests first. Patients aren’t equipped to recognize and resolve these balance bills, highlighting the need for educational support and tools to assist them in managing these costs. Even with the best efforts from payers, there may still be shortcomings in providing care for members during their most critical times.

That’s why Reliant created a mobile app to help members identify balance bills and resolve them on their own or through our billing specialists. We believe members deserve comprehensive support, and we are committed to urging payers to actively seek innovative methods to protect patients and comply with the law.

Taking Control

The No Surprises Act compels payers to essentially transform an out-of-network (OON) experience to an in-network experience, creating significant stress as the enforcement of this complex and changing law continues to mount. With 30 years of experience in managing OON claims, Reliant is perfectly poised to assist payers through NSA compliance with experts dedicated to navigating the regulation. You’ll see the difference in our level of expertise, our comprehensive understanding of NSA regulations, and unprecedented claims transparency and tracking.

Optimize your outcomes and get in contact with our team.

info@relianthp.com